You heard you were supposed to blog or pump out other “content.” You heard Google likes it, or local customers like it, or you can earn some links from it. At least one of those things didn’t turn out as planned. Now it all seems like a big waste.

You can’t tell whether you’ve got a single customer or phone call or link out of it, and pretty you’re sure it hasn’t help you rank for any local search terms you care about. But it does seem to account for a good chunk of your traffic, so you have reason to believe something is there.

Blogging seems too much like a hamster wheel for you to stick with it much longer, but you want to squeeze some benefit out of that one hit, if possible. How can you use that one solid blog post to help your local rankings a little or to help you rustle up a few more local customers? Below are 7 ways (most of which I’ve used to good effect for clients):

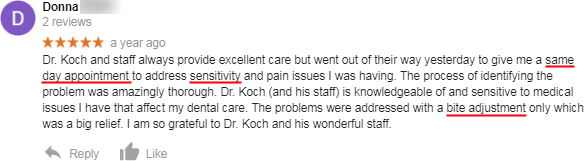

1. Put a call-to-action at or near the top of the post. Gear it to locals – people who could become customers. Consider making the call-to-action big and shameless. Not only might that bit of content help you pick up some local organic rankings, but also any customer you get out of the deal might eventually review you – which also helps your local SEO in a variety of ways. What about the non-local readers? Well, people who want only to read the post can keep reading easily enough.

2. Plop down internal links to relevant pages on your site. Any time you mention a service, product, location/city, or even an FAQ entry or other blog post, link to it. One recurring problem I find is a weak internal-linking game. Outside of the main navigation menu, often there aren’t many trails of breadcrumbs to pages the site owners want people to see. Also, I’ve found that generous internal linking can help rankings pretty significantly, in particular if your site already isn’t brand-new and has at least a few solid inbound links to rub together. Don’t be heavy-handed, but do use a butcher’s thumb.

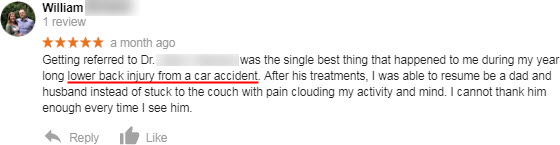

3. Analyze the stuffing out of your post with Google Search Console and Mouseflow. The former will tell you (among other insights) exactly what terms your post ranks for and gets clicks from. The latter will show you (among other insights) video replays of specific visitors’ browsing sessions, allowing you to see exactly how local visitors behave on your post. You’ll get a sense of what brings local people to your blog post, which can tell you how to get more people like them and what you should ask them to do.

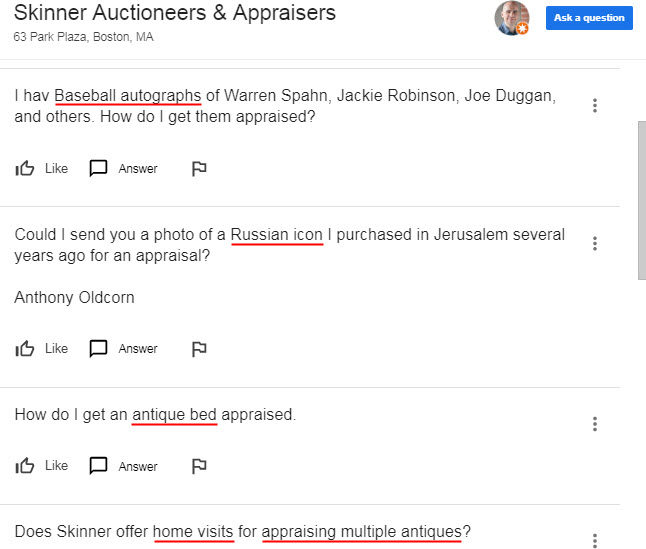

4. Create spin-off pages. Let’s say you’re an auctioneer and you’ve got a blog post with good visibility and clicks (according to Search Console) for a term like “selling Barber Quarters,” even though your post is about “appraising early 20th Century US silver coins” and only a section of it is about Barber Quarters. In that case, make a page all about Barber Quarters. Make it clear to local readers that you can auction their coin collections. Link to the new page it in your hit post and elsewhere on your site.

5. Make a “local” version of your post. (Preferably it’s a page or a YouTube video, or it could be another blog post.) Let’s say your one hit is a post called “Accused of Feline Theft: What to Do Now.” Now consider putting together a page called “Accused of Stealing a Cat in Wisconsin: Local Laws to Know.” You’ll get all the local cat burglars who need legal representation.

6. Or add a “local” section to your post. Same idea as what I described in point #5. You’d opt for this if you don’t think you’d have enough to say in local-specific spin-off version of your post. By the way, it’s fine to add to or update your blog posts well after the publish date. It’s not an anachronism; it’s a service to the reader. (I even do it from time to time. Hope you didn’t notice.)

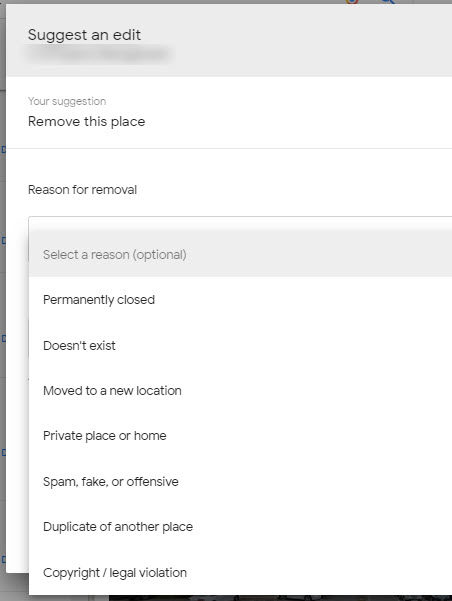

7. If the post received some good inbound links, use it as a temporary link magnet: later on you transplant its content into another page, and 301-redirect the post URL to the page URL. I don’t expect you’ll have too many occasions to want or need to do that kind of footwork. But you’ll want to consider it if eventually you have a “money” page that you really want to benefit from the links your post has, and if you don’t think the post’s content would look to weird as part of that page. (Of course, the reason you haul over the content is so the people who linked to the post don’t remove the links because the page you redirect to isn’t relevant anymore.)

—

I’d still suggest most of those practices even if you’ve got several relative “hit” blog posts, or if blogging or other content-creation consistently works pretty well for you.

Which of those suggestions has helped you turn a solid blog post into local SEO/marketing mojo?

Do you have a blog post that you wish you could translate into some local visibility?

Any strategies I didn’t mention?

Leave a comment!