3 main problems with most keyword research methods, especially for local search:

- They tell you what searchers search for, but not what customers search for

- They rely too much on third-party tools

- They give you analysis paralysis

Most people’s keyword-research strategy is this (more or less):

- Use the “Keyword Planner” in Google Ads

- Use a third-party tool (e.g. SEMRush) to sniff around

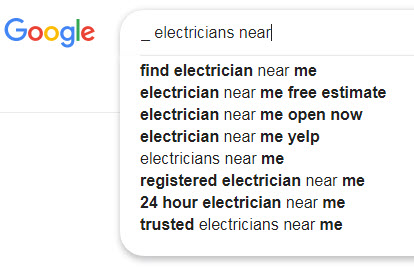

- Type search terms into Google and see what autocomplete belches out

- Type a term into Google and see how many millions of search results Google touts for that term

- Study competitors to get a sense of the keywords they abuse like rented mules

That approach – or some variation on it – isn’t terrible. It has its place in the world, and some good resources (like this and this) can walk you through it. It’s better than nothing, and usually it’s a good way at least to get your sea legs. But it’s still stuck with the problems I mentioned a minute ago.

How do you pick? How do you avoid analysis paralysis? How do you tell a high-volume search term from one the most-relevant or best-converting term? What if you don’t want to use only third-party tools? How do you tell what customers really care about?

You need crunchier intel – either in addition to or instead of what you dig up with conventional methods. At the very least, you need intel that can serve as a tiebreaker, to help you decide which specific search terms (or families of search terms) should be your highest priorities.

Below are 10 straightforward ways to research the local search terms that matter to your business. I’m irritated by tutorials that are so step-by-step you never even finish reading them, and sometimes I over-explain things, so I’ll keep these points brief. (Please let me know in the comments if any could use more explanation.)

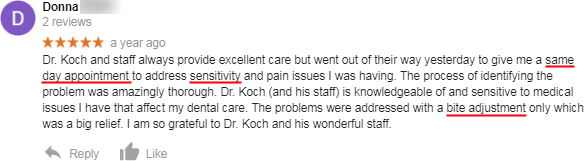

1: Your reviews. You don’t want more people to find you; you want more people to pay you. In most cases, your reviews were written by people who paid you. Mine those reviews. Pay attention to the exact words those people use (especially if you know that they first found you online, rather than came to you through a referral).

2: Competitors’ reviews. Similar reasoning as in point #1. In many cases your competitors’ customers are the same as or much like yours – in terms of needs, knowledge, search habits, and so on – but they just hired the wrong company!

3: Non-competitors’ reviews. I’m talking about businesses in your industry that aren’t in your immediate area. You don’t wrestle with them in the local rankings, so you never or rarely see them, but you should go out of your way to study their reviews.

Whereas probably only a couple of your local competitors are good, if you look farther away you can find plenty more businesses high up the food chain.

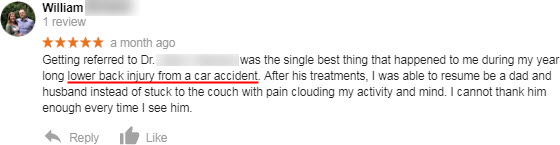

4: The “Acquisition -> Search Console -> Landing Pages” area in Google Analytics, or the ‘Performance” -> “Queries” and “Pages” section of Google Search Console. Read my post on the topic. You’ll probably find that you rank for (and get clicks for) terms you didn’t know you ranked for, because you don’t track them or check on them. You may also find terms for which you already rank well, but want to get additional pages also to rank for those terms. There’s no end to what you can find in there.

5: A “feeler” AdWords campaign. The idea is you set up a Google Ads campaign (search network, not display) strictly to get data. You don’t expect it to bring you a single customer, so maybe you run it only for a couple of weeks before pausing. You scour the “Keywords -> Search Terms” report to see which exact terms people actually searched for, which often aren’t the exact terms you bid on. You mine the data in “Reports -> Predefined reports (Dimensions) -> Locations -> User locations” to see exactly where people searched from – where the “hot spots” are. If you get some business from your Ads campaign, great. The data alone is worth at least few hundred bucks.

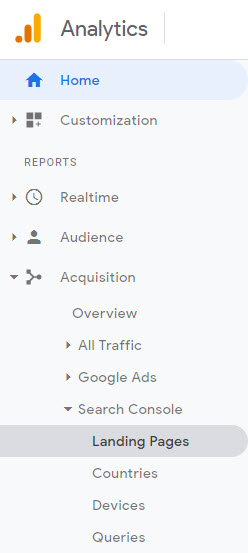

6: Google My Business “Questions & Answers.” Not everyone who asks a question in there is a customer, but most of those people aren’t just casual browsers, either. Look at competitors’ Q&A sections, too.

7: Names of Google My Business categories. Just log into your GMB dashboard and sift through the list. The phrasing of categories isn’t arbitrary. When you research the terms a competitor uses, you learn from people who may have less intel or worse intel than you have. When you research the terms Google uses, you learn from a Borg cube with more data than you can imagine.

8: Names of categories used in local directories and in directories big in your industry. I’m talking about Yelp and YP, but I’m also talking about HealthGrades, Avvo, Houzz, TripAdvisor, and similar sites that cater to specific industries. They’ve probably thrown more time and money at research than you have, and they have more data than you have, so at least see what phrasing they use.

9: Customers’ emails to you, especially their initial inquiries. Or call logs, if you record and transcribe calls. (A great point that Tony Wang mentioned in his comment.)

10: Wildcard searches. Check out my 2015 post on wildcard searches. (Yeah, yeah, I know it’s a variation on the typical strategy of “type stuff into Google and see what autocomplete shows,” but at least you’ll probably see some search terms your competitors probably missed.)

What do you do with good search terms you dig up?

For starters:

- You’ll probably want to create a page on each specific need or search term you unearthed (although that mostly takes care itself if you have an in-depth page on each specific service and/or product you offer, as I always suggest)

- You’ll probably want to mention those needs / services / products on your homepage.

- Consider adding to existing pages a section on whatever high-payoff search term you just learned about. You might phrase it as an FAQ, and put your answer right underneath (maybe with a link to a whole page on it).

- Encourage more reviewers to go into detail. Don’t push keywords on them, though. Most people will mention relevant search terms naturally, when their reviews are more than tiny blurbs.

Any great, less-obvious local keyword-research methods I overlooked?

Which methods have worked best for you?

Any questions about how to use what you find?

Leave a comment!

Very interesting post. Lot’s of new ideas. Thank you.

I’m glad you like it!

Brilliant post Phil! Especially the part about mining reviews for keywords. I read lots of reviews, both of the business and also similar businesses/competitors, but never thought to look specifically for kw’s there. I probably pick stuff up inadvertently, but I’m sure I’ll benefit even more by conscientiously looking for that kind of data.

Same goes for email inquiries (or messages from a contact form). Along the same lines, I often listen to call tracking conversations to give owners feedback and you can learn an awful lot from that. Sometimes people have no idea how to describe what they’re actually needing, so I would add that to the list.

Great point, Tony! Thanks. I’ve added it to #9.

There’s always more to learn by reading reviews – whether yours or others’ (preferably both). Even if it just confirms intel you’ve already got.

Great insights and tips, as always! Thanks Phil

Nice work Phil. I’ve been working on SEO and marketing/web marketing for about 16 years. This is one of the few times I’ve seen an author focus on buyers, not visitors. There have been times when I’ve generated tons of endless visitors. They didn’t buy. Fruitless!!!!! Maybe not–maybe a learning experience.

This is a clever helpful post. I’m scrutinizing what our buyers have said in reviews. That is a thoughtful approach. I’ll add content that reflects their words. They are buyers. Can’t go wrong there.

Meanwhile I just did a draft on a new page that comes from 3rd party keyword help, Ahrefs in this case. Its a phrase I’ve seen. What got me to act is how the competition is so weak. We should get strong visibility. But as you say…its a search phrase with volue….but are they buyers. At this point I don’t know.

I suppose there is room for both…but BUYERS. That is key. Thanks again, Phil. Brilliant.

Thanks, Dave.

Sometimes buyers in their reviews use the same phrases that general searchers use, competitors focus on, and third-party tools (e.g. Ahrefs) dig up. In that case, it’s good at least to confirm your other research by looking at the reviews. But there’s usually some distinction that’s only apparent after you see the reviews.

As you know.

I always like going to the very last page of Queries in GSC > starting from the bottom > then mining my way up from there… there’s always a lot of interesting phrases to find.

I really like your idea of building out content on existing pages that target these outlier type keyword phrases… and doing that with Q&A type content — this is a great idea!

Have you seen the Q&A featured snippets that are being listed within the search results?

I’ve checked these out and found that writing your question in and then the answer is a common theme with these snippet Q&A’s.

So combine that with your idea of building out Q&A’s in your existing pages…

Great post – thank you Phil!

That’s a great approach, Bobby.

Some of my suggestions are to identify “outlier” phrases, but others are ways to identify overlooked variations on big phrases.

The approach to Q&A you describe is what I do, too.

Educational as always Phil. Thank you.

+ double infinity bonus points for ‘borg cube’

More than a few similarities with the GOOG cube.

How long is a feeler campaign good enough, and approx test budget that is generally enough? This is very interested maybe a deeper post just on this might be valuable! Great work

It all depends. In general, I’d leave a feeler campaign up for at least a couple of weeks, and set aside at least a few hundred dollars for it. But that may not be nearly enough in some markets. Again, depends on too many factors.

I learned new things here. Thanks for your effort, but I am surprised that you didn’t mention “ahrefs” keyword Research or local SEO when I listened that this tool belongs to the top 3 positions for keyword research on Google and is a perfect fit in my line of business as well!